MUMBAI (Metro Rail News): The year 2020 has indeed been a roller coaster ride for India as well as the global economy. COVID-19 pandemic had sparked off an unprecedented crisis of significant proportions with economic activities coming to a screeching halt.

When big giants from different industries in India were struggling with their production & sales, JSPL decided to keep its mills running as it turned its focus to export markets like South East Asia, Middle East and Europe to offset the loss in domestic volumes.

The company’s DNA of searching for opportunities in the face of challenges not only allowed JSPL to report a Year on Year growth in shipments in 1QFY21 when the domestic peers reported a sharp drop in volumes but also help support the Indian economy by earning valuable forex.

With the nation gradually unlocking in phases, the recovery has been equally surprising. JSPL has benefited from the sharp economic revival with the company posting 16% Year on Year growth in standalone steel production and 50% Year on Year EBITDA growth in 1HFY21.

Chart showing unmatched growth of JSPL :

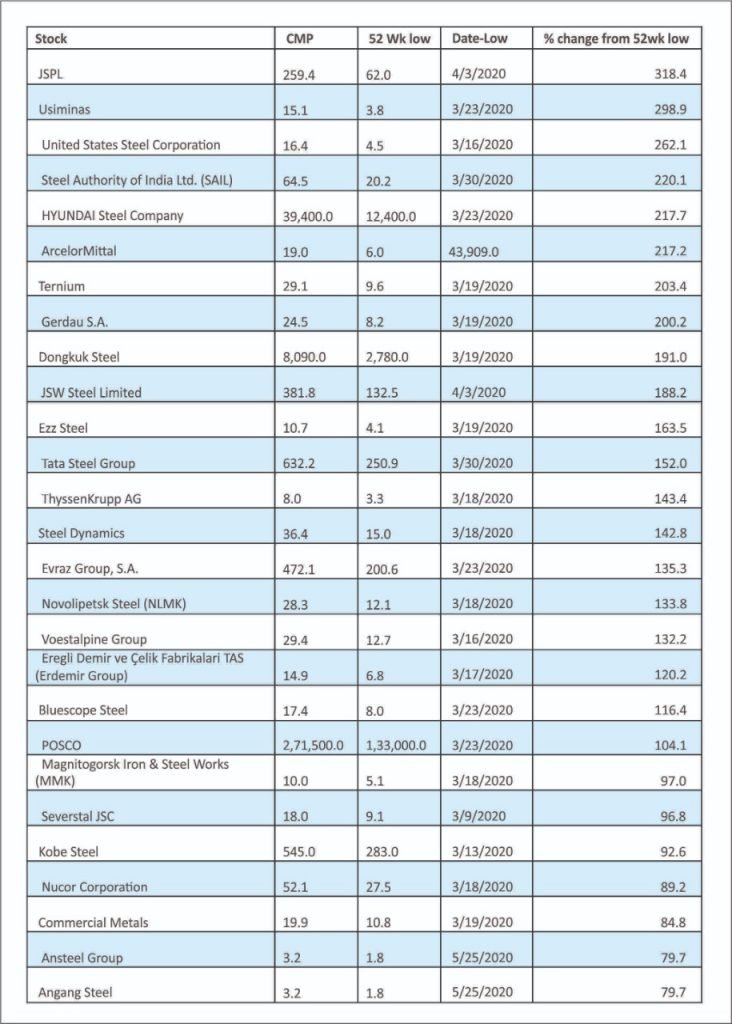

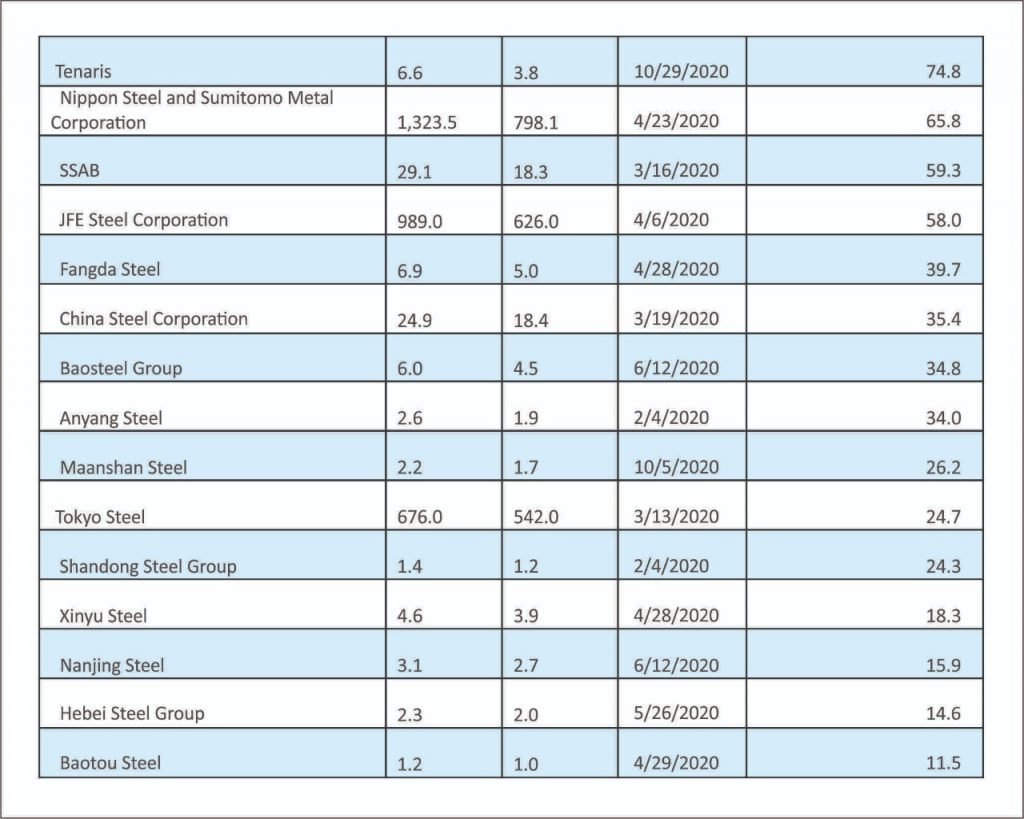

JSPL stock price has also mirrored the economic ups and downs during the year with the scrip rising by 4.3x since hitting 52 weeks low in early April.

“JSPL’s unflinching focus to grow volumes by sweating assets coupled with an unwavering commitment to strengthening the balance sheet has helped the company emerge as the largest wealth creator (from the Apr’20 bottom) in the global steel sector in 2020. With more legs to the economic recovery, we firmly believe JSPL’s outlook to be even brighter”, said Amit Dixit, Vice President Institutional Equities at Edelweiss Securities.