Public Transport Ticketing System: An Overview

NEW DELHI (Metro Rail News): Ticketing is a tool for implementing a price strategy while keeping operational, commercial, and social goals in mind. The ticketing system converts fares into actual means of payment (for the passenger) and collects fares (for the operator).

Several types of tickets are used in public transportation networks (ticket-based price discrimination). In other words, the price depends on the ticket type used. Ticket-based pricing discrimination is pure price discrimination. It makes little difference to an operator’s production costs whether a passenger uses a single ticket, a carnet, or a season ticket to make a trip. Indeed, it costs the same for the operator to transport a student, an older person, or a full-fare client. Differential pricing for such tickets is a strategy to segment the market and maximize income – “airline-style pricing.”

In general, the following types of tickets are used in the public transportation network:

- Single ticket: one journey (no time limit)

– Single Zonal ticket

-Single Destination ticket

- Single ticket: Several journeys within a limited duration

- Single-mode / Single-operator ticket

- Multi-mode / Multi-operator ticket

- Return ticket

- Multi-journey ticket (5, 10, 20)

- Season ticket (day, week, month, year)

- Value ticket (Pay-as-you-go)

- Off-peak ticket / Night ticket

- Combined ticket (ex: Park & Ride)

- Group ticket / Family ticket

- Special event ticket

Ticketing media include:

- Cash

- Tokens

- Paper tickets

- Magnetic strip ticket

- Contact-based smartcards

- Contactless cards

- Mobile ticketing

Onboard vehicles (typically only for single tickets), vending machines, counters, retail shops, the internet, via phone, or through affiliates are all possible sales outlets. Whatever the fare structure and payment scheme, the system’s usability is typically the most significant factor for the passenger. In this regard, harmonizing and unifying tariffs and tickets will make public transportation more accessible. An integrated ticketing system is one in which it makes no financial difference if a passenger needs to board more than one public vehicle to finish their journey. Fare integration encourages travellers to travel because public transportation is considerably easier to use and more accessible.

Electronic Ticketing in Public Transport

Four consecutive generations of ticketing systems coexist in the world today, sometimes even in the same city:

- The oldest system of tokens or paper tickets is still widely used worldwide.

- The magnetic ticketing system that was introduced in the 70s can be classified into two categories:

– Ticketing with automatic belt drive (the most common format)

– Ticketing with a manual sweeping motion of the ticket by the passenger.

- In the 1990s, contactless ticketing became popular. The technology has numerous advantages and rapidly supplants the other two ticketing methods. Some public transportation systems are replacing their first ticketing-generating system with a contactless one, bypassing the magnetic ticket-generation stage. Contactless ticketing communicates between the card and the validation device via Radio Frequency Identification (RFID) or Near Field Communication (NFC) technology.

- Mobile ticketing systems rely on the passenger’s mobile phone to pay for travel expenses. SMS (short text message) or mobile barcodes are used to issue mobile tickets. First, the ticket is selected by sending an SMS to the background system, either with a designating text or to a specific phone number for each conceivable ticket. The user is then sent an electronic ticket through SMS. Users can also use mobile phones to purchase tickets like they can with contactless smartcards by embedding RFID technology inside the device’s battery casing.

In public transportation, e-ticketing systems are more than just payment methods; they also process massive amounts of data, opening up many possibilities for making public transportation easier to use, administer, and regulate. They also provide chances to construct integrated pricing structures that are difficult to achieve with traditional payment methods. The payment method used for electronic ticketing systems is categorized. The closer the card is to the payment system, the more reliable the transaction, but the more limited the user’s options. As a result, the long-term goal is for customers to be able to pay for public transportation without showing or validating any card, depending on entirely automatic fare payment systems. In this context, the following ‘distance range’ possibilities can be differentiated:

- Contact-based technologies are mainly based on standardized communication between user devices (only memory or smart cards) and access systems according to the ISO 7816 standard.

- Proximity technologies are often based on contactless communications according to the different sub-standards of ISO 14443, which results in theoretical transmission distances of about 10 cm.

- Vicinity technologies are related to ISO 15693 and usually cover transmission distances of up to 1m.

- Long-range (or wide-range) technology combines inductive coupling with radio frequency data transmission and requires a battery in the user device (card). While the first communication technique activates the user device while entering a transport vehicle, the second provides contactless data transmission across all locations within the vehicle, including electronic access components at the vehicle’s ceiling. In addition, the system includes anti-collision measures to prevent electronic transactions from colliding, which would otherwise occur.

Multimodal Integrated Ticketing System

Customers’ changing expectations have altered the way transit ticketing works. Tokens, smart cards, and mobile apps have replaced paper tickets worldwide. India, too, plans to build a cashless fee payment method that will function across all of the country’s public transportation networks and day-to-day retail payment systems. Approximately 80% of Indians have bank accounts, and approximately 845 million debit cards are in circulation. Customers will benefit from enhanced mobility and a more seamless travel experience if old cards are replaced by National Common Mobility Cards (NCMCs). NCMC being an open-loop smart card, users also receive various rewards/loyalty points and cash backs. NCMCs also follow the Reserve Bank of India (RBI) policy of processing near-field communication (NFC) transactions below a specific threshold value (currently INR 2,000) without requiring a personal identification number (PIN).

Key Points for NCMC

- Bank-issued standard and secure payment method based on dual interface and EMV+ standard.

- Service area (reserved space) on the card for storage of passes and last-tap information.

- Common payment standard, applicable for prepaid/debit and credit cards.

- Provision of stored value (money) cards which can be accessed offline and speed up transactions.

Major Ecosystems

The multimodal integrated ticketing system is getting increasingly popular. Some of the famous and successful examples are cited as under:

Singapore

- Policies have been drafted to have transit systems integrated with new commercial development.

- The metro network is connected to the bus network.

- TransLink enables the usage of a standard fare card across all modes.

Australia

- The project is called the Australian Integrated Multimodal Ecosystem (AIMES).

- Tap-and-go payments can be made through existing NFC-enabled cards.

- Data on where and how people are moving is collected.

- The connectivity of all modes of transport, including walking, is considered.

Key Considerations for PTOs

Currently, transit fare payment systems are dispersed across most Indian cities and are not cost-viable for public transportation operators (PTOs) and banks. Transit operators have recently recognized the necessity of developing a multimodal transit system that is compatible between cities. Thus, transit payments are gaining pace, and the concept of an interconnected multimodal transport ecosystem has gained hold in a few places thanks to innovative fare media that uses RuPay EMV card technology. All PTOs and banks must use the same technology. This will prevent PTO fragmentation and the implementation of non-standardized fare collecting. Standardization will also operate as a catalyst, lowering costs through economies of scale.

To deploy a multimodal integrated ticketing management system, PTOs/transport authorities/the transit industry must address several essential factors.

(i) Acceptance of transit cards issued by multiple issuing entities: Transport operators implementing NCMCs are enrolling a single issuing bank with 3-5 years of exclusivity to stabilize the system and provide the bank with an opportunity to make more revenue during this period. This strategy is cost-effective for PTOs since it allows the bank to submit a lower bid during the tendering process and split a portion of the profits with the transport operator as royalty income. Transport operators may require several onboard participants or accept NCMCs issued by other banks or PTOs when implementing an ITS. If transportation operators begin accepting transit cards produced by other issuing bodies, they will be responsible for paying the merchant discount rate (MDR) to cover the following:

(a) Payment Scheme Switching Charges

(b) Interchange Amount to the issuer

(ii) Set-up of Acquiring Bank: The acquiring bank’s primary duty is facilitating an acceptance infrastructure. Because this is primarily a back-office activity, it is up to the operator to select an acquiring bank that minimizes operational costs while maximizing transaction efficiency. PTOs can investigate the following alternative possibilities for delivering integrated fare payment systems, which give a fundamentally different paradigm:

(a) Common single acquiring bank: A fully connected and efficient ITS design would necessitate the appointment of a joint acquiring bank for the Special purpose vehicle (SPV) responsible for all acquiring transactions through the transit ecosystem for the entire state/region. In this situation, the SPV appoints a single acquirer bank to handle all ITS transactions, while multiple banks are authorized to issue scheme-specific cards to clients.

(b) Transport operator-wise acquiring bank: Alternatively, each PTO might work with a different acquiring bank. Though the SPV will manage the ITS scheme, its obligations should be limited to planning, testing, certification, and specification issuance. While this allows individual operators operational independence, the overall scheme will only support smart card interoperability without an ITS.

(iii) Blacklist Management: One of the most difficult challenges for transportation providers is conveying information about blocked cards to validators via the central scheme player. Aside from executing transit transactions, a system must be developed to transport the list of banned cards from the issuer bank to the central scheme, then from the scheme to the acquiring bank, and finally to the validators. The parties must also agree on the development of a risk management system.

(iv) Revision in Settlement Process : The settlement procedure may be altered to account for the many parties, such as schemes, PTOs, issuing banks, and acquiring banks. It must cover the interchange cost, switching fee, fare transaction sharing fee, top-up fee, card issue fee, and other fees charged by PTOs and banks for transit and non-transit transactions.

(v) Data Analytics: The vast amount and variety of data supplied by numerous transit sources are particularly important for service planning and management. This data is generated in real-time and can be used to plan future routes or implement new fare rules such as flat rates and integrated fares. This information can also be monetized.

(vi) Management of Card Service Area: When a multimodal transportation system is implemented, one card will be used in several metro gates. While standard single-journey validations may work, the service area on the EMV card must be tailored to the PTO to issue different period passes. Passengers may utilize particular period passes to access metro services if such passes can be used for separate services. This could aid in the analysis of metro station trips.

(vii) Merchant Discount Rate: The transport operator must consider the acquirer’s costs for host management, scheme fees, and interchange fees when determining the MDR.

(viii) Non-Fare Box Revenue: Apart from transit revenue, PTOs may consider obtaining non-fare money from advertising on station premises and through the mobile app, branding of station names, over-the-counter/app-based selling of event tickets, and the allocation of parking spots to cab aggregators.

Latest Developments

– India is about a decade behind in mass transit payment systems. Card-based payments have been deployed by several public sector enterprises, including Kochi Metro and Delhi Metro; however, they are ‘closed-loop’ payment instruments. Startups seek to change this by creating more open-loop payment cards that can be used in buses and metros, local stores, and auto-rickshaws. In addition, cities such as London, Dubai, and Hong Kong have created their own “mobility payment cards” that operate on an open-loop payment concept and have been in use for over a decade.

– As India gradually restores public transportation, financial businesses such as CityCash and Chalo focus on mass transit payment products. While Covid-19 forced consumers to buy everything from groceries to electronics to clothing online, cash remained the primary mode of payment for mass transit or public transportation systems such as buses, trains, and metro rail.

– Payment firms are negotiating with state-owned bus corporations and waterways to mass-adopt NFC-enabled, ‘open loop’ prepaid cards for transit ticketing. According to industry estimates, more than 68 million commuters use public transportation daily.

– Following the Reserve Bank of India’s notification permitting online payments even in places with intermittent internet access, mass transit payment startups can experiment with hitherto unrecognized concepts.

– There is a vast market opportunity for open-loop payment cards in the bus ticketing space. Almost 200 million Indians use public transportation each year, with 70-80 million using it daily. However, the majority of these payments are done in cash. Since its launch in September 2019, CityCash has issued around 3 million cards to customers and is accepted in 20,000 buses in Maharashtra.

– Chalo, a mass transit payment startup, approaches the mobility payment challenge from all angles. It provides payment gear such as an NFC-enabled point-of-sale device, a mobile app that tracks buses and routes in real-time, and an NFC-enabled prepaid card for offline transactions.

– Chalo also provides an electronic bus pass that can be obtained through the Chalo smartphone app. It is now available in Indore, Bhopal, Patna, Guwahati, Kolkata, Thiruvananthapuram, Madurai, Vijayawada, and Udupi. The startup is also looking into accepting card-based payments from e-rickshaw drivers. It is also in discussions with the Kochi water transport authority about installing GPS in their water ferries and accepting Chalo cards.

– A unified mobility card for Mumbai’s local trains, Metro Rail, BEST buses, and other means of transportation has been suggested for several years. There is anticipation that the project will get off to a good start this year. BEST is the first transport company in Mumbai to formally announce that its whole system is now compliant with the National Common Mobility Card (NCMC) and that an NCMC smartcard may be tapped on its portable machines for seamless travel in all AC and non-AC buses.

– The Metro rail (Versova-Ghatkopar corridor) may soon follow, with its systems modernized and rendered NCMC-compliant. According to one official, in two months, a standard mobility card may be introduced at all entry/exit gates along the corridor. The Mumbai Railway Vikas Corporation (MRVC) has appointed a consultant to speed up the joint mobility card project, which is expected to begin soon.

– IRCTC currently uses I-PAY as its in-house payment gateway. I-PAY permits purchases of the train, bus, and air travel tickets, as well as tour packages, through the IRCTC website and mobile app. This implies that IRCTC already has a user base that may be interested in using its payment gateway. Potential partnerships with retailers could broaden the reach of the railway PSU.

– According to the IRCTC’s annual general meeting, as a payment aggregator, it will provide, promote, develop, create, and carry on the business of all sorts of electronic and virtual payment system services, payment gateway and aggregator services, prepaid and post-paid payment instruments, payment systems including open, closed, and semi-closed payment instrument systems in India and overseas.

– The IRCTC gateway will also serve as a bill payment gateway, accepting payments for utility bills, levies, and municipal taxes by the Bharat Bill Payment System (BBPS) rules.

Conclusion

To increase public transportation usage, communities should strive to make the ticketing system appealing and straightforward to grasp everyone. The price structure should be consistent and accessible, with sufficient tickets to meet the users’ needs. Fares should be straightforward to understand. Tickets and payment options, for example, should be publicly available.

- At sales points distributed throughout the city

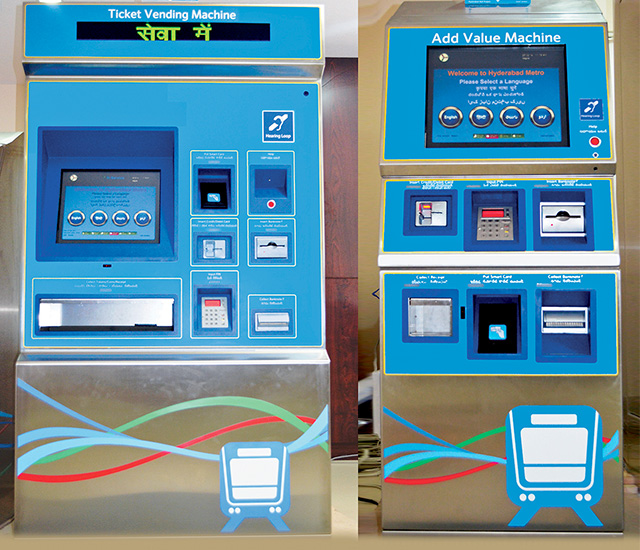

- At ticket vending machines at various places (e.g. at park and ride stations, at central bus stops or in vehicles)

- On the internet (e.g. subscription for intelligent card holders) • Via mobile phones Integrated ticketing and tariff policies between different public transport operators (e.g. local public transport and the national railway) should be offered to make tickets valid for all public transport modes and the whole region.

- Via Mobile Phones

Multiple public transportation operators should supply integrated ticketing and tariff policies (e.g., local public transportation and the national railway) to make tickets valid for all modes of public transportation and for an entire region.

Payment alternatives that are simple and appealing should be available. For example, innovative, intelligent card systems can be built and used for contactless payment of integrated fares. They may also play a significant role in public transportation marketing. Smart payments can also provide valuable data on user behaviour and mobility trends.