Introduction

Hyderabad is the capital and largest city of the Indian state of Telangana. Spread over 650 square kilometres (250 square miles) on the Deccan Plateau, it lies along the banks of the Musi River in the northern part of Southern India. According to the 2011 Census of India, the city had a population of 6.9 million within its limits and 9.7 million in the metropolitan region, making it the fourth most populous city and the sixth largest metropolitan area in the country.

Hyderabad was known for its flourishing pearl trade until the 19th century and was nicknamed “City of Pearls”. Hyderabad was once the world’s exclusive trading centre for Golconda diamonds. Many of its historic bazaars continue to operate today, preserving the city’s rich heritage. Its strategic position between the Deccan Plateau and the Western Ghats, coupled with rapid industrialisation during the 20th century, helped attract major research institutions, manufacturing industries, and financial establishments. Since the 1990s, Hyderabad has developed into a prominent Indian hub for pharmaceuticals, biotechnology, and information technology.

Urban Growth and the Need for Metro System in Hyderabad

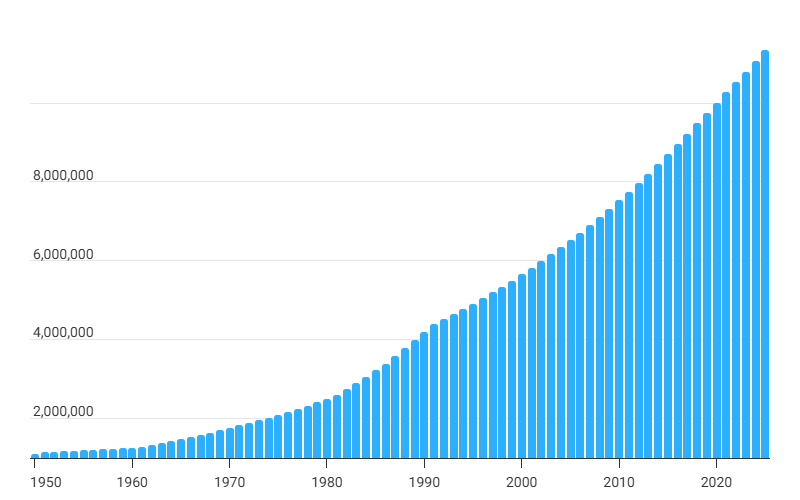

Hyderabad’s Total Population By Year

Hyderabad has experienced rapid and continuous urban growth over the past several decades, as reflected in the steadily rising population shown in the graph. From a modest urban base in the 1950s, the city’s population has expanded sharply, especially after the 1990s, driven by IT sector growth, economic diversification, and large-scale migration. This surge placed immense pressure on existing modes of transportation leading to severe traffic congestion and increased pollution in Hyderabad.

As the city continued expanding, the traditional transport modes could no longer meet mobility demands efficiently. This created a critical need for a modern, reliable, and high-capacity public transport solution. The establishment of the metro system emerged as a strategic response to these challenges.

Hyderabad Metro : Enhancing Connectivity and Urban Development

Overview

The Hyderabad Metro Rail Project is an urban Mass Rapid Transit System (MRTS) being built to serve Hyderabad, the capital of Telangana.Currently the Phase 1 of Hyderabad Metro which spans 69.2 km covering 3 corridors is completely operational. While the Phase 2 of Hyderabad Metro spanning 76.4 km is currently under proposal stage.

Key Specification

| Speed and Track | Top Speed: 80 kmph |

| Average Speed: 33 kmph | |

| Track Gauge: Standard Gauge – 1435 mm | |

| Electrification | 25 kV, 50 Hz AC overhead catenary (OHE) |

| Signalling | Communication-based Train Control (CBTC) |

Hyderabad Metro Phase 1

Overview

Phase 1 of the Hyderabad Metro spans 69.2 km, covering 3 operational metro corridors. The Construction for Hyderabad Metro Phase 1 started in April 2012. The estimated cost for Hyderabad Metro phase 1 was ₹22,148 crore.

| Corridor | Route | Length | Total No. of Stations |

| Corridor-I (Red Line) | Miyapur to LB Nagar | 29 km | 27 Stations |

| Corridor-II (Green Line) | JBS to MGBS | 11.2 km | 10 Stations |

| Corridor-III (Blue Line) | Nagole to Raidurg | 29 kms | 23 Stations |

Hyderabad Metro Phase 1: The World’s Largest Public-Private Partnership in Metro Rail

The Hyderabad Metro Phase 1 became the world’s largest Public-Private Partnership (PPP) in the metro rail sector. Larsen and Toubro Limited was awarded the Hyderabad Metro Rail Project by the then Government of Andhra Pradesh. L&T incorporated a Special Purpose Vehicle (SPV) –L&T Metro Rail Hyderabad Limited (L&TMRHL) to implement the Project on Design, Build, Finance, Operate and Transfer (DBFOT) basis.

On 4th September, 2010, the company signed the Concession Agreement with the then Government of Andhra Pradesh and achieved the financial closure for the Project on 1st March, 2011, in a record period of six months.

Hyderabad Metro Phase 1 Timeline

| Corridor | Route | Length | Opening Date |

| Corridor-III (Blue Line | Nagole – Ameerpet | 17.60 km | 29 November 2017 |

| Corridor-I (Red Line) | Miyapur – Ameerpet | 12.20 km | 29 November 2017 |

| Corridor-I (Red Line) | Ameerpet – LB Nagar | 16 km | 24 September 2018 |

| Corridor-III (Blue Line | Ameerpet – HITEC City | 8.5 km | 20 March 2019 |

| Corridor-III (Blue Line | HITEC City – Raidurg | 1.5 km | 29 November 2019 |

| Corridor-II (Green Line) | JBS – MGBS | 9.6 km | 7 February 2020 |

Hyderabad Metro Phase-I Absorption: Structural Gaps in the PPP Model

Phase 1 of the Hyderabad Metro was developed under a Public-Private Partnership (PPP) model, where was L&T responsible for financing, constructing, and operating the network, while the government provided land, approvals, and other support. Under this structure, L&T held a 90% stake in the project, and the government held the remaining 10%. The intent behind adopting the PPP approach was to utilise private-sector investment, expertise, and operational efficiency, thereby reducing the financial load on the government.

Over time, however, the model did not function as expected. The project encountered cost escalations, construction delays, and revenue levels that remained below projections. The COVID-19 period further impacted ridership and earnings, which weakened the financial viability of the PPP framework. As a result, L&T struggled to recover its investment and began incurring substantial losses. The company had also taken loans at comparatively higher interest rates, which added to its financial burden and contributed to the stress on the overall project structure.

Annual Losses Reported by LTMRHL

| Financial Year (FY) | Loss After Tax (₹ in Crore) |

| 2024-25 | ₹625.88 crore |

| 2023-24 | ₹555.04 crore |

| 2022-23 | ₹1,315.94 crore |

| 2021-22 | ₹1,745.85 crore |

| 2020-21 | ₹1,766.74 crore |

L&T’s Decision to Exit Hyderabad Metro

Hyderabad’s metro network, which was among the largest in the country a decade ago, has not expanded since the completion of Phase 1. As other cities added new corridors, Hyderabad moved from the 2nd position in 2014 to the 9th position today. To close this gap, the Telangana government has prepared plans for about 163 km of new corridors under Phase 2A and 2B.

During the appraisal process, the Government of India examined how the project is proposed to be executed.The GoI also suggested that L&T join the Phase 2 project as one of the equity partners. L&T informed the government that it cannot take an equity role in Phase 2 and cannot sign the proposed integration agreement. In September 2025, L&T officially conveyed its willingness to offer its equity stake in the project to the state or central government.

On 25 September 2025, Chief Minister A. Revanth Reddy met L&T Group CMD S. N. Subrahmanyan along with senior officials from both sides to review the status of Hyderabad Metro’s Phase 2.

Discussion Points

The state government expressed that it would prefer L&T to remain an equity partner in the Phase 2 expansion. L&T clarified that the company has moved out of the business of owning and operating transport concession projects and therefore cannot take up equity participation in the new phase.

The Chief Minister then asked L&T to at least sign the Definitive Agreement required for integrating operations of Phase 1 and Phase 2. This agreement is important because the Government of India has asked for clearly defined arrangements for operations, maintenance, revenue sharing, and cost allocation across the two phases.

L&T repeated its earlier proposal that it is ready to transfer its entire equity in the Phase 1 project to the state government. If accepted, Phase 1 would shift from a PPP model to a fully state-owned system.

Final Verdict

Following several rounds of discussions, both parties arrived at an in-principle understanding on the financial settlement for Phase 1.

The Government of Telangana will assume responsibility for the debt of the Phase 1 project, which is approximately ₹13,000 crore. In addition to taking over the liabilities, the state will make a one-time payment of around ₹2,000 crore to L&T. This amount represents L&T’s equity investment in L&T Metro Rail Hyderabad Ltd (LTMRHL) and will serve as the final settlement for their involvement in the project.

Understanding Why the World’s Largest Metro PPP Project Became Unviable

1. Project Delays and Cost Overruns

The project was delayed by about 32 months due to pending right-of-way (RoW) clearances, alterations in the approved alignment, and other related issues. As a result, the overall project cost increased from the original estimate of ₹16,375 crore to a revised figure of ₹18,975 crore.

2. High Debt Burden and Interest Costs

The project followed a PPP structure, with L&T raising loans from a consortium of 10 banks at an interest rate of about 10%. Even with a daily ridership of around 4.8 lakh and annual revenues above ₹1,100 crore, the project reported a loss of ₹625 crore in FY25. Cumulative losses since inception have exceeded ₹6,600 crore. Although the Metro generates more than ₹1.5 crore per day, the revenue is not sufficient to meet its debt servicing obligations. In FY23, the system earned ₹703.20 crore from fares, station rentals, and advertising, while operating expenses stood at ₹429 crore. Despite a positive operating margin, the high interest burden continued to push the balance sheet into losses. If L&T had continued in the project, the outstanding debt of about ₹13,000 crore would have resulted in an annual interest outflow of roughly ₹1,300 crore.

3. Failure to Monetise Non-Fare Revenue

The original model had projected that 45% of its total revenue would be generated from advertising, likely through selling ad space within the large commercial complex. However, L&T developed only about 2 lakh sq. ft. (approx. 200,000 sq. ft.) of commercial space, a fraction of the planned 18.5 lakh sq. ft. (approx. 1.85 million sq. ft.). This inability to generate sufficient non-fare revenue left the project overly reliant on ticket sales, which were insufficient to cover the massive debt obligations

4. Impact of the COVID-19 Pandemic

The pandemic struck immediately after the full commissioning of the metro in February 2020. This resulted in a complete shutdown for 169 days, which reduced the daily commuter base (ridership dropped from a peak of 4.75 lakh to less than 2 lakh during some periods).

5. Lack of Sustained Government Support

L&T pointed out that the project did not receive consistent financial support from the state government. After the COVID-19 period, L&T informed the BRS administration that the project’s finances had become unsustainable and requested additional support. A discussion was held with the then Chief Minister K. Chandrashekar Rao, after which the government set up a committee to examine the issue. The committee included Minister K. T. Rama Rao and senior officers Arvind Kumar, K. Rama Krishna Rao, and Jayesh Ranjan.

L&T’s request was for a ₹3,000 crore soft loan to cover pandemic-related losses and delayed cash flows. As per a senior government official, the state agreed to provide only ₹1,000 crore. The remaining ₹2,000 crore requested by L&T was not sanctioned.

Hyderabad Metro Phase-IIA: Submission Status and Approval Clarity

Project Structure and Cost

- The Hyderabad Metro Rail Phase-II project is planned as a Joint Venture between the Government of India (GoI) and the Government of Telangana (GoTG), with an estimated project cost of ₹24,269 crore. The Detailed Project Report (DPR), along with the required technical, financial, and environmental documentation, has been prepared in full compliance with Government of India norms. The project includes five corridors spanning 76.4 km.

State Government’s Position

- According to the Government of Telangana, the DPR for Hyderabad Metro Phase-II was formally submitted to the Ministry of Housing and Urban Affairs (MoHUA) on 4 November 2024. The State asserts that all supporting documents were duly forwarded for central appraisal and funding approval under the new metro policy framework.

Union Minister’s Statement

- Contrary to the State’s claim, Union Minister of Coal and Mines G. Kishan Reddy recently stated that the revised DPR for the 76.4 km Phase-II expansion has not yet reached MoHUA. His remarks suggest that the updated DPR has either not been received, not been acknowledged, or is still pending within internal processing channels.

Current Clarity Gap

- This divergence between the State Government’s declaration of submission and the Union Minister’s assertion of non-receipt has created a clarity gap in the approval process. Until MoHUA officially confirms receipt and begins formal examination, the project cannot move to subsequent stages such as Public Investment Board (PIB) review, Cabinet approval, and finalisation of central financial assistance.

- The proposed five corridors, which primarily serve as extensions of the existing Phase-I network, are detailed as follows.

| Corridor | Route | Length | Total No. of Stations | Estimated Cost (₹ crore) |

| Corridor IV: Airport Metro Corridor | Nagole – Shamshabad RGIA | 36.8 km | 24 Stations | ₹11,226 |

| Corridor V: Extension of Blue Line | Raidurg – Kokapet Neopolis | 11.6 km | 8 Stations | ₹4,318 |

| Corridor VI: Extension of Green Line | MGBS – Chandrayangutta | 7.5 km | 6 Stations | ₹2,741 |

| Corridor VII: Extension of Red Line | Miyapur – Patancheru | 13.4 km | 10 Stations | ₹4,107 |

| Corridor VIII: Extension of Red Line | LB Nagar – Hayat Nagar | 7.1 km | 6 Stations | ₹1,877 |

| Total | 76.4km | ₹24,269 |

Hyderabad Metro Phase-IIA Funding Structure

| Source | Amount (₹ crore) | Share of Total Cost |

| Telangana Government | ₹7,313 | 30% |

| Union Government | ₹4,230 | 18% |

| Multilateral Development Banks (JICA, ADB, NDB) | ₹11,693 | 48% |

| Public–Private Partnership (PPP) | ₹1,033 | 4% |

| Total | ₹24,269 | 100% |

Advantages of Multilateral Financing for Hyderabad Metro

One of the major strengths of the Hyderabad Metro Phase-II financial structure is the availability of long-term, low-interest loans from Multilateral Development Banks (MDBs) such as JICA, ADB, and NDB. These institutions provide financing on terms that are more favourable than those available from domestic commercial banks.

Unlike Indian banks, which typically charge 9–10% interest for large infrastructure loans, MDBs offer financing at around 2% interest.

In addition to low interest rates, MDB loans also come with much longer repayment horizons. They generally offer:

- A moratorium of 5-10 years, during which only minimal payments are required and no principal amount is due

- A repayment period of up to 30 years, which allows the borrower to spread repayments across a far longer timeframe.

This means the total repayment window can stretch to over 40 years, which will give the Telangana Government ample financial flexibility.

Hyderabad Phase II-B

In June 2025, the Telangana government approved Hyderabad Metro Rail Phase II-B. This phase covers 3 corridors with a combined length of 86.1 km. The project will be executed by Hyderabad Airport Metro Limited (HAML) under a 50:50 joint venture arrangement between the state government and the central government. The estimated cost for Phase II-B is ₹19,579 crore.

Phase II-B Corridors

| Corridor | Route Description | Length (km) |

| Corridor IX | RGIA to Future City (Skills University) | 39.6 km |

| Corridor X | JBS to Medchal | 24.5 km |

| Corridor XI | JBS to Shamirpet | 22 km |

Proposed Funding Structure

| Funding Source | Amount (₹ crore) | Share (%) |

| Telangana Government | 5,874 | 30% |

| Government of India | 3,254 | 18% |

| Loan Component (JICA, ADB, NDB, etc.) | 9,398 | 48% |

| PPP Component | 783 | 4% |

Next-Phase Requirements for Hyderbad Metro Project

- Refinancing the High-Interest Debt

For the authorities to secure funding for the next phase of the Hyderabad Metro, it is essential to first address the outstanding liabilities of Phase 1. A major opportunity for the State lies in refinancing the high-cost commercial debt through cheaper, long-term sovereign-backed loans from multilateral development banks.

Current Situation

- Commercial debt: ₹13,000 crore

- Interest rate: 10%

- Annual interest outflow: ₹1,300 crore

If refinanced through multilateral lenders (JICA, ADB, AIIB etc.) at around 2.5%, the annual interest is expected to reduce to roughly ₹325 crore, enabling annual savings of nearly ₹975 crore.

- Operational Continuity and Operator Transition

Operational continuity will be a key requirement during the transition of Hyderabad Metro Phase-I. L&T Metro Rail Hyderabad, the concessionaire, has extended Keolis’ Operations and Maintenance (O&M) contract until November 2026. With this timeline in place, the Government of Telangana will need to prepare a structured transition plan for taking over O&M responsibilities. The plan should ensure that system safety standards are maintained, technical expertise is retained, and trained staff are absorbed without disruption. It will also be necessary to prevent any interruption to passenger services while establishing long-term institutional arrangements for operations.

- Managing Operating Costs and Revenue Gaps

The Hyderabad Metro continues to face a gap between operating costs and farebox revenue. Electricity expenses, staffing, and maintenance create a large recurring cost structure. The upcoming model must include a more predictable revenue model built on non-fare income streams such as station retail, advertisements, property leasing, and real estate development. However, these sources require structured contracts, market-linked pricing, and efficient management. It is imperative to work on these segments to reduce dependence on fare hikes, which remain politically sensitive.

- Multimodal Integration

The long-term success of the metro depends on connecting it effectively with buses, MMTS, intermediate public transport (IPT), and other mobility systems. Authorities need to implement integrated ticketing, physical interchange facilities, and coordinated route planning to ensure balanced passenger distribution. Without these improvements, the metro may continue to face uneven ridership high loads in IT corridors and low usage in residential belts.

Conclusion

The Hyderabad Metro project has reached a critical stage where expansion plans under Phase 2A and Phase 2B are moving forward while unresolved liabilities of approximately ₹13,000 crore from Phase 1 remain a major barrier. Until this liability is formally absorbed, refinanced, or restructured, it will be difficult for the implementing agencies to secure new loans or multilateral funding for the next phase of the network.

A key procedural challenge is the closure of the existing Concessionaire Agreement (CA) between L&T Metro Rail Hyderabad and the Government of Telangana. Senior officials from both sides acknowledge that the legal processes involved will be lengthy, particularly in areas related to termination conditions, compensation, asset transfer, and lender protections. These steps will need to be completed before ownership, operations, and financial responsibilities can be fully shifted to the State.

The overall progress of Hyderabad Metro in the coming years will depend on how efficiently the State is able to resolve Phase-I liabilities, complete the legal closure of the concession, secure long-term refinancing, and establish a stable operational framework. The effective handling of these components will determine the viability of Phase-II implementation and the long-term sustainability of the metro system.

Join the 6th edition of InnoMetro to explore how the progressions in AI are improving the railway systems, including ticketing, rolling stock, and signalling. Witness the innovation from 200+ exhibitors at India’s leading show for metro & railways which is going to held on 21-22 May 2026 at Bharat Mandapam, New Delhi

Register now: https://innometro.com/visitor-registration/